It’s starting to look like that the good times for the television market to an end starts running. Major global media conglomerates such as Time Warner (owner of, among other HBO) and 21st Century Fox – short Fox – in America have begun to reduce the number of complaints

Now the average advertising time in the United. States accumulated over the years to more than fifteen minutes per hour (!) television. In the past, some television stations even use compression technology to films and series slightly accelerated playback, so there is more time left for the commercial breaks .

What is the reason for this sudden change of course in advertising policy? One of the main reasons for this is the changing behavior of consumers.

More via smartphone

It is a known phenomenon that consumers since the advent of the Internet spend less time reading newspapers and magazines. However, since the introduction of the smartphone and tablet spend Consumers also an increasingly smaller portion of their time watching television and even online (via PC or laptop) increasing in recent years off.

Today, spend users average more than 25% of their (media) time on their smartphone or tablet. Increasingly, they use these devices except for social media, games or online purchases for watching videos.

The way content is consumed is changing. An example is the bing watching . It is understood that viewers a new series often see in a few days as a whole, instead of every week waiting for the next episode.

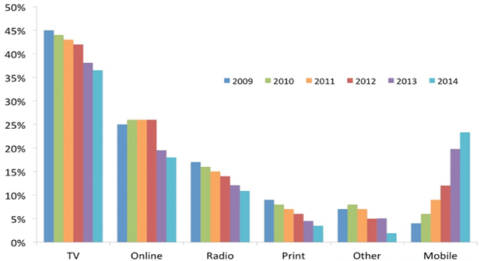

Time spent by consumers on various forms of media

Click on the chart for a larger version, source: Business Insider

Looking for scope

The above. chart makes clear why the television medium for advertisers begin to lose its luster. If an advertisement on television has a smaller range, the value of such advertising for the advertiser will also lower.

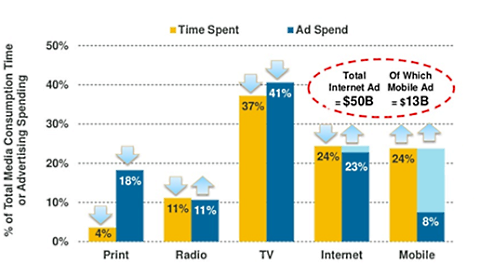

It is remarkable (see below), despite the fact that consumers only 4% their free time to spend on newspapers and magazines, there are still more than 15% of the total advertising budget on this type of media is spent.

But it is inevitable that advertisers seek out other forms of media with a wider reach. This same scenario is likely for television as more and more consumers to consume differently television.

Increased competition

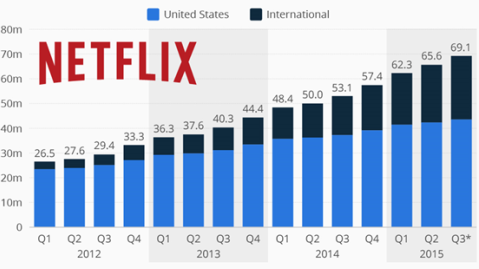

Meanwhile, increased competition for traditional television providers increasing. As Internet television service Netflix worldwide for nearly seventy million users in more than sixty countries. In the Netherlands, the video service very successful as founder Reed Hastings more than one million customers.

In addition, Facebook reported that the number of video views on the social network had increased during the quarter to eight billion per day (!) compared to one billion per day in 2014.

Finally, every minute is a further hundred hours of video content uploaded to YouTube, so the choice for consumers is bad.

Time Allocation compared to ad spending

Click on the chart for a larger version, source: Mary Meeker, KPCB

. less watching television

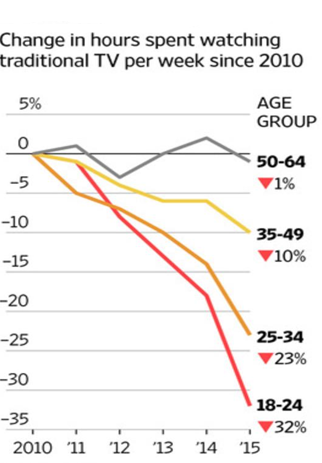

To get an idea of how the future will look like, I look at the behavior of millennials, young people. According to the Wall Street Journal in almost all age groups showed a decrease in the number of hours watched television. However, this decrease is strongest among the young.

Thus, the number of hours of television per week for youngsters in the age group of 18 to 24 years decreased by more than 30% over the last five years. It is clear that advertisers who want to reach this group should be a different tune tapping

Changing viewing habits among young people

No cable required

A recent study by Forrester Research predicts that in 2025 only half of young people (aged 18-31 years) will have to subscribe to cable TV, 15% of them will belong to the cord-cutters , or those who did have a subscription, but have canceled.

However, the most telling statistic is that of the cord-nevers . It is expected that in 2025 approximately 35% of young people have no cable subscription more and view all their video content from Netflix, YouTube or streaming services such as Hulu.

Another interesting development is the fact that services like Netflix busy with the production of exclusive content for their subscribers. The popular House of Cards here is perhaps the most famous exponent. Orange is the New Black and series of Narcos are other examples.

The latest film by Brad Pitt, War Machine – about the US war in Afghanistan – Netflix offers exclusively for its subscribers

Vicious Circle

users continuously with the latest series and movies (without intermediate commercials or ads). Netflix is trying its subscribers to stronger loyalty. The business model here is largely dependent on.

The more subscribers, the higher the monthly income, and the more money can be spent again on new content, which makes the service more attractive to both existing and new subscribers.

The user growth at Netflix

Click on the chart for a larger version, source: statista, Netflix

.

Popular content

What is now above all for you as an investor and for me as a fund manager? It’s my job to position the portfolio so that investors can benefit from these developments.

It will not surprise you that I have become a bit more cautious about the prospects of the companies operating in the media sector, and particularly those businesses that rely heavily on ad revenue.

Companies with high quality and popular content in today’s changing environment is probably best positioned. You can think of:

- popular series like Game of Thrones

- live sports like Premier League football

- films, such as the expected mega blockbuster Star Wars

also play modern video platforms like Netflix, Google (YouTube) and Facebook well to the changing viewing habits of consumers. In short, plenty of opportunities for investors but the industry to continue to follow closely.

Jack Neele since April 2006 portfolio manager at Robeco. Jack previously spent seven years at Mees Pierson as a portfolio manager active global equity and he was also responsible for alternative investments. This publication is not intended as (individual) investment advice nor as a solicitation or an offer to buy or sell securities or other financial instruments. Robeco may at any time have the shares or other instruments mentioned in this column in the portfolio. Twitter:.jackneele

No comments:

Post a Comment